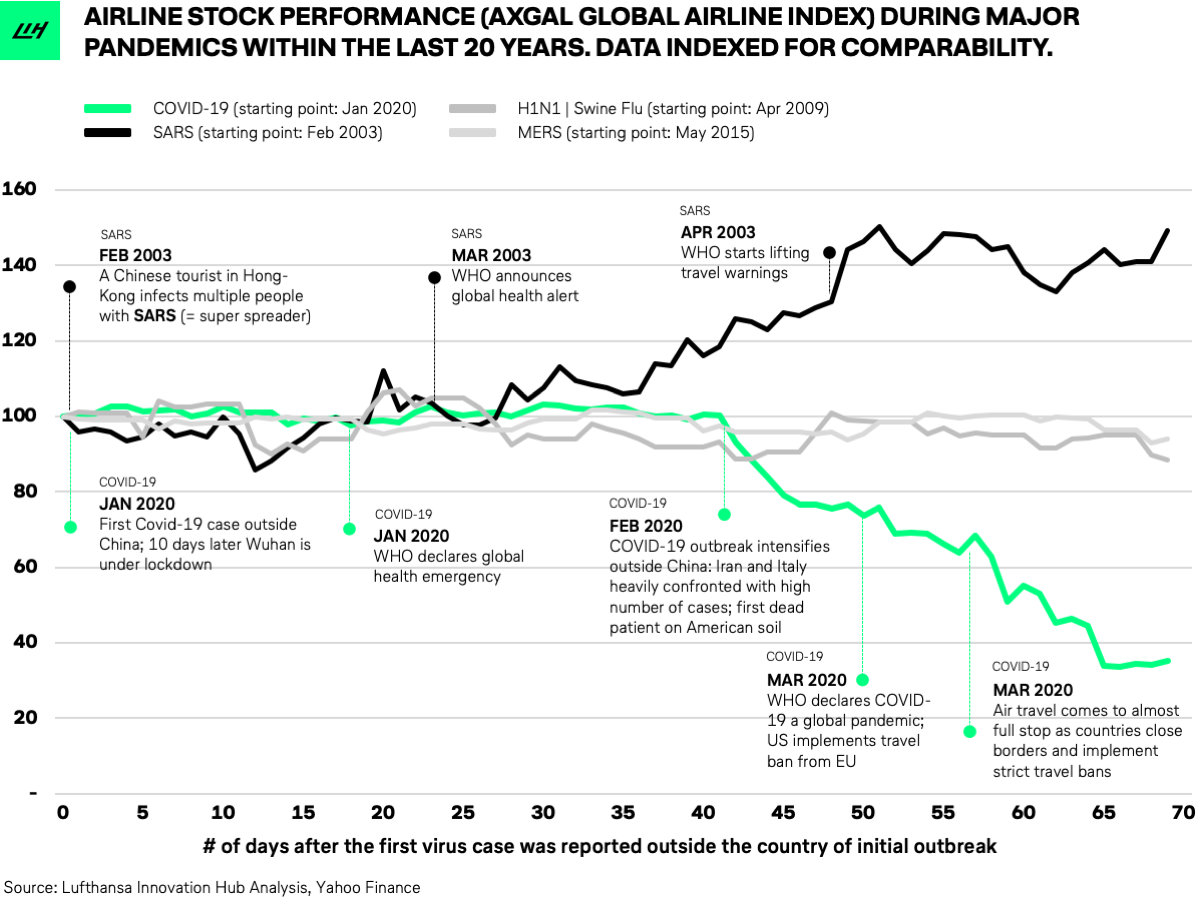

COVID-19 is a different beast than any other of the major virus outbreaks we have seen in the past two decades. A comparison of airlines’ stock price performance during COVID-19, SARS, H1N1 (Swine Flu) and MERS clearly shows that this time is different.

As the International Air Transport Association (IATA) recently reported, the coronavirus outbreak will have an impact on the financial performance of the industry unlike anything we have seen before. Current estimates (as of March 22) project that industry passenger revenues could plummet $252 billion or 44% below 2019’s figure and industry cash burn exceeding $60 billion in Q2 only. We expect these estimations to become even more bearish over the next few weeks as air travel demand has evaporated in all regions of the world by now – see our Flight Demand Tracker.

Not surprisingly, airline stocks have plunged in response. The Arca Global Airline Index (AXGAL), which comprises more than 30 of the world’s most capitalized and liquid international airline companies, has lost more than 60% of its value in only four weeks.